LBA's 2023 Year in Review summarizes the Association's activities and accomplishments, from helping banks with recruiting to leading advocacy efforts to equipping banks to address fraud and insurance reform.

LBA on Mission

In 2023, LBA's staff of 9 brought 172 years of association experience—an average tenure of 19.1 years each.

LBA strives to be driven and defined by our members. Each year, LBA leadership gathers issues of concern and challenges from bankers, especially during the summer membership meetings. Those issues are used as the basis of the LBA Board’s strategic discussion in September. As a result of that discussion, the board identified three main priorities: insurance, fraud and talent. These priorities set in motion:

- Meetings with the new Commissioner of Insurance Tim Temple and an insurance coalition of stakeholders to begin work on legislation in the 2024 to address the insurance environment in Louisiana

- Education programs and work on legislation that will focus on financial crime penalties

- Education programs on bank compensation, outreach to potential bank employees and resources for employee retention

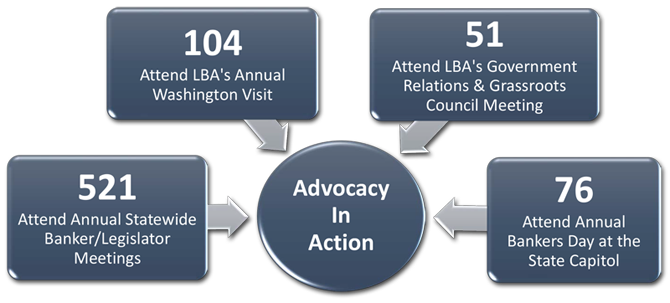

Advocacy

LBA’s government relations team is trusted, respected and dedicated to promoting and preserving the pro-banking environment in Louisiana. LBA saw continued legislative success during the 2023 State Legislative Session, including passing 3 LBA-supported bills and 1 resolution that were signed into law:

- Act 218 by Rep. Tony Bacala created a new, combined crime of theft or criminal access of an ATM, which carries a penalty of mandatory imprisonment, along with a fine and the requirement to make restitution for damage caused. This new, specific state crime related to ATMs greatly enhances criminal penalties for these types of crimes. The bill was brought by LBA and the Louisiana Sheriffs' Association due to increasing ATM crime being carried out by organized criminals and conducted in various ways. Act 218 specifically covers the various ways that the crime is being conducted and requires a mandatory five-year prison sentence upon conviction.

- HCR 59 by Rep. Beau Beaullieu and Rep. Beryl Amedee is a resolution that urges and requests the U.S. Securities and Exchange Commission to immediately withdraw its proposed rule entitled "The Enhancement and Standardization of Climate-Related Disclosures for Investors". The proposed federal rule would require publicly traded companies, including financial institutions, to disclose enhanced climate-related information, including their greenhouse gas emissions and GHG emissions that occur in the upstream and downstream activities of their value chain. If finalized, this harmful proposal would cause covered companies and their small business customers to incur significant expense and devote significant resources to comply, while providing information of dubious value to investors.

- Act 267 by Rep. Nicky Muscarello requires students to successfully complete a one unit (one year) financial literacy course to graduate from high school and to qualify for TOPS. The provisions of the Act apply to students who enter the ninth grade during the 2024-2025 school year and thereafter. Louisiana bankers played a pivotal role in obtaining this strong level of legislative support. This result is due to decades of hard work by Louisiana bankers, among others, who have made providing and teaching financial literacy in their communities a top priority.

- Act 390 by Sen. Franklin Foil provides for online judicial sales. The Act authorizes, but does not mandate, sheriffs to conduct judicial sales on movables and immovables through the use of an online internet platform. Each sheriff will be able to decide whether to continue holding in-person sales or move to the new online sales procedure. Use of an online sales process could result in more bidders and higher bids at sheriffs sales. It is also expected to be more convenient for seizing creditors to be able to monitor and participate in sheriff sales online rather than having to physically attend or send someone to attend an in-person sheriff sale at the parish courthouse.

Monitor, Track, Act

During the 2023 state legislative session, 1,600 bills, resolutions and study requests were reviewed by LBA and 100% of the bills that LBA identified as harmful to banks and their customers were either favorably amended or defeated during the state legislative process.

- 36,000+ emails were sent to distribute 27 LBA Government Relations Update bulletins

- 2,300+ messages were sent through LBA’s VoterVoice Call to Action campaigns to members of the Louisiana congressional delegation

- Between the February Statewide Banker/Legislator Meetings and the August Statewide Banker Luncheons, LBA staff traveled 3,900+ miles to lead 18 meetings

- Started a new recognition program for banks that prioritize participation in all areas of LBA's government relations activities called Advocacy Bank Champions Club. The inaugural members of the ABC Club totaled 22 banks.

- LBA State PAC 2023 contributions totaled $120,447 from 68 banks—the fourth recording-breaking year for LBA's State PAC

- LBA Fed PAC 2023 contributions totaled $89,885

- There were 32 members of Cliff's Club, which recognizes institutions whose employees and directors collectively give $1,000 or more to the Fed PAC

- LBA member banks and bankers have contributed over $3.1 million to the LBA PACs since 2001

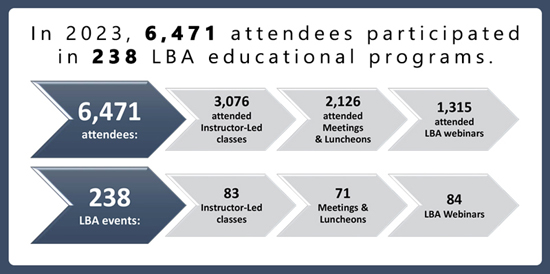

Professional Development/Education

In 2023, LBA continued to offer training in a variety of delivery methods—live stream via Zoom, program recordings and in-person. LBA remains the leading provider of high-quality, cost-effective professional development training for Louisiana banks. Our education opportunities provide an invaluable opportunity to network with peers and stay current on important issues affecting our rapidly changing industry.

Giving Back

For 66 years, the Louisiana Bankers Education Council has accomplished its mission of facilitating banker development and promoting financial literacy outreach to Louisiana bankers through its various programs, including the new LBEC Ambassador program, Louisiana Young Banker Impact Award, Bank-at-School program, Simply Banking study guides, College Freshman Scholarships, 365 to Rich Bank Shadow Day, Leadership School, partnering with Louisiana JumpStart Coalition and managing the Louisiana Bankers Patrick Spencer/FISC Education Foundation which funds the above programs.

- 620 bankers have graduated from LBA's Leadership School since the school began in 2010

- In 2023, 30 College Freshman Scholarships were awarded to students who work for or have a parent who works for an LBA member bank, bringing the total amount awarded as scholarships since 2001 to more than $440,000

- Awarded the third annual Louisiana Young Banker Impact Awards, an award created to honor Louisiana bankers who are 45 years old or younger for their contribution to their bank and/or the banking industry.

- The second session, including the first graduating class, of the Louisiana Tech University's School of Business was held June 2023 with 82 bankers in attendance and 44 bankers graduating.

- Record-breaking participation in the 2023 365 to Rich Bank Shadow Day Program, with 7 LBA member banks hosting 19 bank shadow days with more than 248 students, including the first bank shadow day in Mississippi and second bank shadow day in Texas. Total high school seniors that have participated in the program since the program began in 2016: 819.

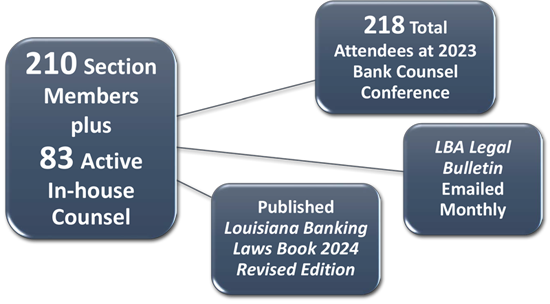

Bank Counsel Section

The LBA Bank Counsel Section consists of bank attorneys who work as in-house and outside counsel. Under the direction of the Bank Counsel Committee members, section members assist in drafting legislation and work closely with the LBA government relations and legal staff throughout the year.

The annual Bank Counsel Conference continued to increase its reach with 7 state banking association co-sponsors and attendees from 11 states.

Endorsed Products & Associate Members

LBA Endorsed Products and

Associate Members provide banks with superior products and services. These partners are industry leaders who share LBA's high standard for quality service.

13 Total LBA Endorsed Vendors

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

LBA Associate Members "associate" themselves with Louisiana's commercial banks and thrifts by monitoring developments in the banking industry with the information they receive from the Association.

Member Services

In 2023, Cookies and Careers in Banking events were held at Grambling State University, Nicholls State University and University of Louisiana at Lafayette—continuing to work towards the goal of hosting a Cookies and Careers in Banking event at all Louisiana public colleges. At each event, school of business students are invited to hear from a panel of bankers about careers in banking and are encouraged to bring their resume, which will be shared with banks who participate.

In 2023, LBA staff traveled 1,900+ miles to 9 Emergency Preparedness Coalition meetings with 150+ people in attendance. LBA started the annual meetings in 2006, the year after Hurricane Katrina, to facilitate emergency preparedness discussions between bankers, regulators and emergency preparedness officials from local governments. 2023 marked the 18th year that LBA has hosted these meeting ahead of hurricane season.

- The LBA Career Center generated more than 8,700 visits in 2023 and includes:

- LBA Job Bank, individual job openings posted by LBA members with 53 classifieds posted in 2023

- Member Job Board, an annual subscription available to LBA members where they can post a link to their bank’s career opportunities webpage.

74 LBA Service Awards were presented in 2023, bringing the total presentations since 2001 to 590 LBA Service Awards—awards representing more than 25,000 years of service to the banking industry. LBA Service Awards are presented to bankers with 45 years or more of active banking service in Louisiana banks.

Community Cash, a surcharge-free ATM alliance allowing participating banks’ customers access to the combined ATM locations, had 16 alliance members in 2023, with more than 544 ATM locations in 9 states. The alliance also serves as a disaster recovery aid for displaced customers of alliance members during any natural disaster.

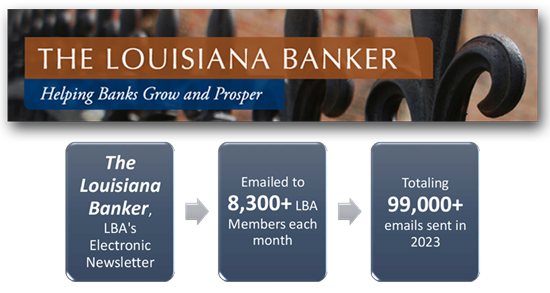

Communications

LBA Communications keeps bankers informed, delivering critical industry information to members about legislative and regulatory changes as well as conferences, programs and products and services available to members. LBA also works to keep the public informed on key issues through its social media profiles and releases sent to media outlets throughout the state.

LBA.org

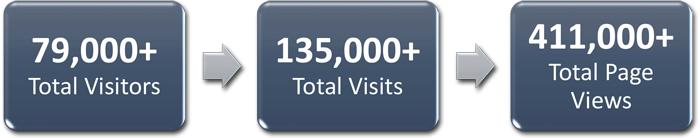

On average each month in 2023, more than 6,600 visitors together made about 11,300 visits to LBA's website, viewing more than 34,000 pages as they browsed. There are more than 11,200 registered website users and the most popular pages continue to be the Education Calendar and event websites, Classifieds, Peer Group Pages, Press Releases & Photo Gallery, LBA's electronic newsletter & bulletins and The Bankers Directory.

Social Media

The LBA regularly posts resources covering topics like financial literacy, identity theft and emergency preparedness on Facebook, X and LinkedIn that can be shared on members’ social media outlets to benefit their customers.

LBA's hashtags help spread the good news about Louisiana banking.

- #LBAatWork features LBA members attending LBA events.

- #FinLitLouisiana features the many financial literacy programs and community projects around the state.

- #LouisianaBanksSupportingLouisiana features how Louisiana bankers tirelessly work to help neighbors and local businesses.

In 2023, LBA social media posts on LinkedIn, Facebook and X generated more than 500,000 impressions spreading the good news of banking. LBA's top social media posts center around our members—promoting awards received by both banks and bankers, advocacy and outreach activities, participation in professional development opportunities, celebrating bankers' career-long service to the banking industry, awarding college freshman scholarships to children of member bank employees and honoring LBA staff work anniversaries.