LBA's 2022 Year in Review summarizes the Association's activities and accomplishments, from helping banks recruiting efforts with LBEC's Cookies and Careers in Banking to aiding advocacy efforts by raising record amounts for LBA's State and Federal PACs to expanding career development resources in the PWR Forward section of LBA's website.

LBA on Mission

In 2022, LBA's staff of 9 brought 163 years of association experience—an average tenure of 18.1 years each—to partner with LBA members to accomplish LBA's mission—helping banks grow & prosper.

The Louisiana Bankers Education Council hosted the first-ever Cookies and Careers in Banking in the fall of 2022 at Southern University in Baton Rouge. The goal is to host a Cookies and Careers in Banking event at all Louisiana public colleges. Students from the school of business at each college will be invited to join a panel of bankers to learn more about a career in banking. The students are encouraged to bring their resumes to the event, which will be shared with banks who participate. The students will also be offered the opportunity to connect with a banker mentor.

Advocacy

LBA’s government relations team is trusted, respected and dedicated to promoting and preserving the pro-banking environment in Louisiana. LBA saw continued legislative success during the 2022 State Legislative Session, including passing 5 LBA-supported bills and resolutions that were signed into law:

- Act 257 by Sen. Barry Milligan amended the Payable on Death deposit account statutes to allow a depositor to designate a POD beneficiary or beneficiaries in the account agreement. The Act repealed the requirement that a depositor for a POD account designate a beneficiary by separate affidavit.

- Act 261 by Sen. Mike Reese amended the Louisiana Banking Code to clarify how obligations under the oppressed shareholder remedy provisions of the Louisiana Business Corporations Law apply to a bank holding company. This Act was designed to provide an additional explanation of how certain banking regulatory requirements and limitations must be considered before a court decides to impose the remedy of requiring a bank holding company to purchase a withdrawing shareholder’s shares.

- Act 91 by Sen. Franklin Foil amended the Code of Civil Procedure and state banking code to allow first mortgage holders to disclose loan balance/payoff amounts in response to a subpoena duces tecum to the sheriff or to HELOC lenders or other second mortgage lenders. The sheriff needs the superior mortgage payoff amount to set the minimum bid for sheriff sale.

- Act 547 by Sen. Cameron Henry reduces barriers to entry to the appraisal profession by adopting a program called Practical Applications of Real Estate Appraisal. PAREA was created by the Appraiser Qualifications Board, which is a national body, to provide an alternative to the traditional supervisor/trainee model for gaining appraisal experience. The Act also allows a certified residential appraiser to appraise “all other real or immovable property, which is the subject of an appraisal involving or having a market value of $500,000 or less.”

- Act 156 by Rep. Mike Johnson amended the state limited liability company law to provide that when the sole member of an LLC dies and leaves no operating agreement providing for who has authority to act on behalf of the LLC when a sole member dies, the decedent's succession representative may take action regarding the affairs of the LLC.

Monitor, Track, Act

During the 2022 state legislative session, 2,300 bills, resolutions and study requests were reviewed by LBA and 100% of the bills that LBA identified as harmful to banks and their customers were either favorably amended or defeated during the state legislative process.

- 38,000+ emails were sent to distribute the 28 LBA Government Relations Update bulletins produced in 2022

- Between the February Statewide Banker/Legislator Meetings and the August Statewide Banker Luncheons, LBA staff traveled 3,800+ miles to lead 18 meetings

- LBA State PAC 2022 contributions totaled $107,436 from 61 banks—the third recording-breaking year for LBA's State PAC.

- LBA Fed PAC 2022 contributions totaled $95,109 from 669 individuals—a new record amount raised for LBA's Fed PAC.

- There were 32 members of Cliff's Club for 2022, which recognizes institutions whose employees and directors collectively give $1,000 or more to the Fed PAC.

- LBA member banks and bankers have contributed nearly $2 million to the LBA PACs since 2001.

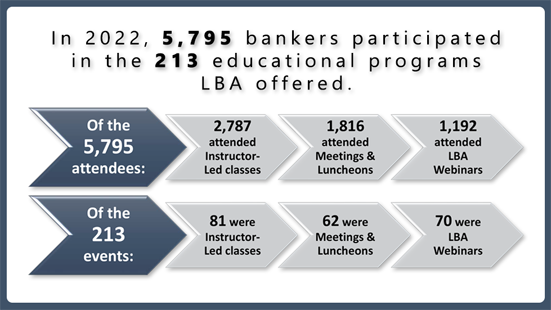

Professional Development/Education

In 2022, LBA offered training in a variety of delivery methods—live stream via Zoom, program recordings and in-person. LBA remains the leading provider of high-quality, cost-effective professional development training for Louisiana banks. Our education opportunities provide an invaluable opportunity to network with peers and stay current on important issues affecting our rapidly changing industry.

Giving Back

For 65 years, the Louisiana Bankers Education Council has accomplished its mission of facilitating banker development and promoting financial literacy outreach to Louisiana bankers through its various programs, including the Bank-at-School program, Simply Banking study guides, College Freshman Scholarships, 365 to Rich Bank Shadow Day, Leadership School, partnering with Louisiana JumpStart Coalition and managing the Louisiana Bankers Patrick Spencer/FISC Education Foundation which funds the above programs.

- 565 bankers have graduated from LBA's Leadership School since the school began in 2010.

- In 2022, 27 College Freshman Scholarships were awarded to students who work for or have a parent who works for an LBA member bank, bringing the total amount awarded as scholarships since 2001 to $410,229.

- $1,024,648 total balance, including contributions and pledges, to the Louisiana Bankers Patrick Spencer/FISC Education Foundation.

- Awarded the second annual Louisiana Young Banker Impact Awards in 2022, an award created to honor Louisiana bankers who are 45 years old or younger for their contribution to their bank and/or the banking industry.

- The first session of the Louisiana Tech University's School of Business was held June 2022 with 47 bankers in attendance.

- Resumed 365 to Rich program after a two-year pause, with five LBA Member Banks hosting six Bank Shadow Days with more than 130 students! For the first time in program history, 365 to Rich crossed state lines with the first Bank Shadow Day in Texas.

- LBEC hosted two fundraisersin 2022 to benefit the Louisiana Bankers Patrick Spencer/FISC Education Foundation—a second annual Skeet Shoot in Mangham that raised over $2,300 and a Golf Tournament in Baton Rouge that raised over $3,600.

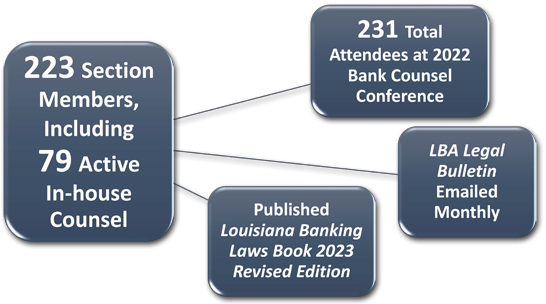

Bank Counsel Section

The LBA Bank Counsel Section consists of bank attorneys who work as in-house and outside counsel. Under the direction of the Bank Counsel Committee members, section members assist in drafting legislation and work closely with the LBA government relations and legal staff throughout the year.

- In 2022, the annual Bank Counsel Conference was co-sponsored by Alabama Bankers Association, Arkansas Bankers Association and Mississippi Bankers Association, with attendees from seven states.

Endorsed Products & Associate Members

LBA Endorsed Products and

Associate Members provide banks with superior products and services. These partners are industry leaders who share LBA's high standard for quality service.

14 Total LBA Endorsed Vendors

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

LBA Associate Members "associate" themselves with Louisiana's commercial banks and thrifts by monitoring developments in the banking industry with the information they receive from the Association.

Member Services

The Careers section of LBA's website was renamed PWR Forward to reflect the expanded member resources aimed at helping bankers advance their careers. The section currently includes five toolkits, a lending library, a summary and comparison chart of banking and leadership schools in Louisiana and a growing list of development resources.

- The LBA Career Center generated more than 12,000 visits in 2022 and includes:

- LBA Job Bank, individual job openings posted by LBA members with 89 classifieds posted in 2022.

- Member Job Board, an annual subscription available to LBA members where they can post a link to their bank’s career opportunities webpage.

51 LBA Service Awards were presented in 2022, bringing the total presentations since 2001 to 516 LBA Service Awards—awards representing more than 22,000 years of service to the banking industry. LBA Service Awards are presented to bankers with 45 years or more of active banking service in Louisiana banks.

Community Cash, a surcharge-free ATM alliance allowing participating banks’ customers access to the combined ATM locations, had 15 alliance members in 2022, with more than 520 ATM locations in 9 states. The alliance also serves as a disaster recovery aid for displaced customers of alliance members during any natural disaster.

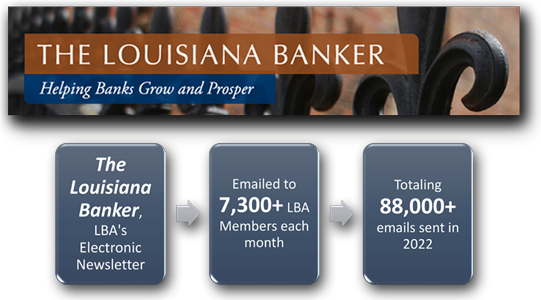

Communications

LBA Communications keeps bankers informed, delivering critical industry information to members about legislative and regulatory changes as well as conferences, programs and products and services available to members. LBA also works to keep the public informed on key issues through its social media profiles and releases sent to media outlets throughout the state.

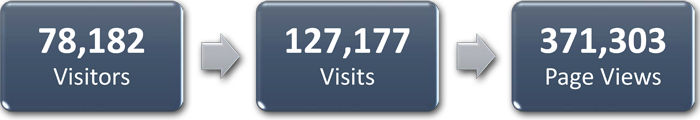

LBA.org

On average each month in 2022, more than 6,500 visitors together made about 10,500 visits to LBA's website, viewing more than 31,000 pages as they browsed. There are more than 10,800 registered website users and the most popular pages continue to be the Education Calendar, Classifieds, Peer Group Pages, Press Releases & Photo Gallery, LBA's electronic newsletter & bulletins and The Bankers Directory.

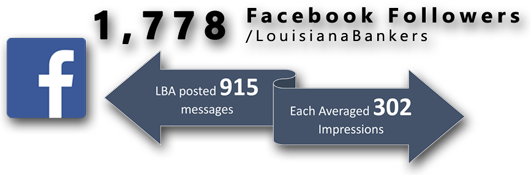

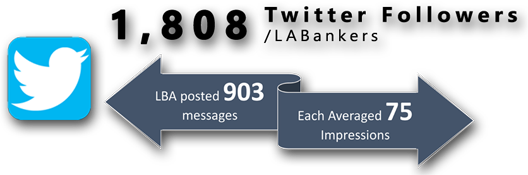

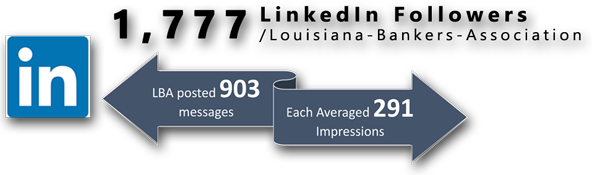

Social Media

The LBA regularly posts resources covering topics like financial literacy, identity theft and emergency preparedness on Facebook, Twitter and LinkedIn that can be re-posted or re-tweeted on members’ social media outlets to benefit their customers.

In 2022, LBA added to their list of hashtags to help spread the good news about Louisiana banking.

- #LBAatWork—LBA’s newest hashtag—features LBA members attending LBA events.

- #FinLitLouisiana showcases the many financial literacy programs and community projects around the state.

- #LouisianaBanksSupportingLouisiana showcases how Louisiana bankers tirelessly work to help neighbors and local businesses.

2022 Social Media Statistics

Top 2022 post on our Facebook, Twitter and LinkedIn LBA pages: The LBA Board of Directors has announced the election of Ginger Laurent as LBA Chief Executive Officer, effective Jan. 1, 2022. She is the first female elected CEO in the LBA’s 122-year history. http://ow.ly/sgae50HsfBh

- Facebook had 11,879 impressions and 2,631 engagements

- Twitter had 3,364 impressions and 102 reactions

- LinkedIn had 25,264 impressions and 637 reactions