LBA's 2020 Year in Review offers a summary of the Association's activities and accomplishments. 2020 was an unprecedented year in many ways and below is a glimpse of how LBA's staff adapted to the challenges faced throughout the year to serve Louisiana banks through government relations, education and communication.

LBA on Mission

LBA's staff of 10 brings a total of 174 years of association experience—that's an average tenure of 17.4 years each—to partner with LBA members to accomplish LBA's mission—helping banks grow & prosper.

- LBA began hosting Banker Calls on March 16 in an effort to provide the latest Coronavirus information to member banks. By the end of 2020, LBA hosted 64 banker calls with more than 18,000 bankers dialing in.

- Notes from these calls plus industry-specific resources were posted to LBA's Coronavirus Resources section—an area that quickly became one of the most visited on LBA's website, ranking in the top 5 of the most popular pages on the website for 2020.

- LBA also distributed three press releases related to Coronavirus and Paycheck Protection Program loans to media around the state and consumers on social media channels, which ended up totaling more impressions and reaching a larger audience than any previous LBA social media posts.

The Diversity & Inclusion section was added to LBA's website to give member banks a starting point to create an employee Diversity & Inclusion Advisory Council. The resource includes a Template and Resource Library.

- LBA’s employment classifieds received an upgrade in 2020 and is now called LBA Career Center. The redesigned resource includes:

- LBA Job Bank, previously called Employment Classifieds, continues to list individual job openings posted by LBA members.

- Member Job Board, a new annual subscription available to LBA members where they can post a link to their bank’s career opportunities webpage.

- LBA members posted a total of 66 Classifieds in LBA's Career Center in 2020, generating more than 16,000 visits to that section on LBA's website.

30 LBA Service Awards were presented in 2020, bringing the total presentations since 2001 to 430 LBA Service Awards—awards that represent more than 19,000 years of service to the banking industry. LBA Service Awards are presented to bankers who have 45 years or more of active banking service in Louisiana banks.

Advocacy

LBA’s government relations team is trusted, respected and dedicated to promoting and preserving the pro-banking environment in Louisiana. LBA saw continued legislative success during the 2020 State Legislative sessions, including passing 7 LBA-supported bills that were signed into law:

- Act 254 by Rep. Ray Garofalo enacts remote notary procedures and standards and also facilitates the recording of tangible copies of electronic notarized documents when clerks of court are not yet able to accept electronic documents for recording. This Act helps modernize Louisiana law for the future when electronic and remote transactions will be more frequent, and can be helpful to banks that have a shortage of notaries in certain bank branches.

- Act 195 by Rep. Francis Thompson provides that banks can pledge as security for state government deposits anything that the state can invest public funds in directly, and removes restrictions on maturity dates of securities pledged as collateral.

- Act 289 by Rep. Mike Huval amends the municipal public funds law to remove restrictions on maturity dates of securities pledged as collateral to secure local public funds.

- Act 109 by Rep. Greg Miller creates a state statute that improves the ability of a bank to use and enforce electronic signatures.

- Act 236 by Sen. Ronnie Johns and Rep. Rodney Lyons provides for a more detailed procedure, and clear immunity language, for banks to sell or dispose of abandoned property contained in a drilled safety deposit box to help pay the lien for unpaid rent, the costs of drilling a box and storing contents.

- Act 336 by Rep. Thomas Pressly protects businesses that operate responsibly from frivolous litigation related to COVID-19. LBA worked with the Louisiana Association of Business and Industry and a coalition of other business groups on this important legislation.

- Act 46 by Rep. Paula Davis from the Second Extraordinary Session gives clear authority to banks, savings banks, savings and loan associations, and their holding companies to hold shareholder and member meetings remotely.

(Above pictures were taken at live meetings held prior to the pandemic.)

(Above pictures were taken at live meetings held prior to the pandemic.)

Monitor, Track, Act

During the 2020 state legislative sessions, 2,349 bills, resolutions and study requests were reviewed by LBA and 100% of the bills that were identified by LBA as harmful to banks and their customers were either favorably amended or defeated during the state legislative process.

- 2,436 messages were sent through LBA’s VoterVoice Call to Action campaigns to members of the Louisiana Congressional Delegation.

- 61,000+ emails were sent to distribute the 48 LBA Government Relations Update bulletins produced in 2020.

- LBA State PAC 2020 contributions totaled $101,345 from 64 banks—which, thanks to members, ended up being a record-breaking year in spite of the challenges faced during a pandemic and active hurricane season.

- LBA Fed PAC 2020 contributions totaled $83,332 from 611 individuals.

- There were 35 members of Cliff's Club for 2020, which recognizes institutions whose employees and directors collectively give $1,000 or more to the Fed PAC.

- LBA member banks and bankers have contributed over $1.6 million to the LBA PACs since 2011.

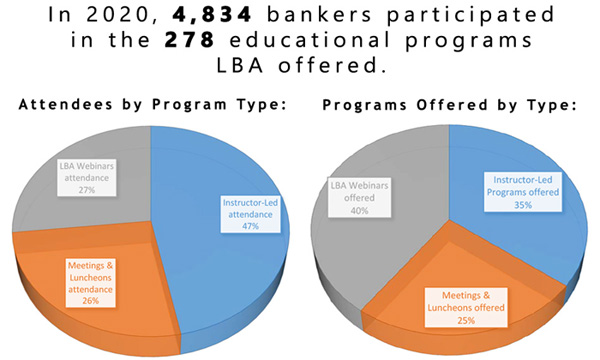

Professional Development/Education

In 2020, LBA staff encountered more challenges to how professional development programs could be delivered than ever before. Programs traditionally held in-person—seminars, conferences, schools and even LBA's annual convention—were developed into programs that could be delivered virtually out of necessity. And while the format for most programs changed, LBA continued to be the leading provider of high-quality, cost-effective professional development training for Louisiana banks. LBA adapted and continued to provide members with the opportunity to network with peers and stay current on important issues affecting a rapidly-changing industry.

- Total attendees for LBA's first-ever virtual Annual Convention & Exposition: 439

- 4,000+ bankers have graduated from LBA's Bankers School for Supervisory Training since the school began in 1973

- There are 29 active LBA Peer Groups & the number continues to grow at the request of bankers. New peer group added in 2020: Corporate Secretary

New for 2020, LBA made Virtual Seminar Recordings available for purchase. There are more than 20 programs currently available, with topics ranging from deposit accounts, annual BSA training, compliance, collections and bankruptcy, cybersecurity and more.

Giving Back

For 63 years, the Louisiana Bankers Education Council has accomplished its mission of facilitating banker development and promoting financial literacy outreach to Louisiana bankers through their various programs, including the Bank-at-School program, Simply Banking study guides, College Freshman Scholarships, 365 to Rich Bank Shadow Day, Leadership School, partnering with Louisiana JumpStart Coalition and managing the Louisiana Bankers Patrick Spencer/FISC Education Foundation which funds the above programs.

- 460 bankers have graduated from LBA's Leadership School since the school began in 2010. LBA was able to hold two sessions of the school in 2020, transitioning to virtual for the second half of the first school held and conducting the entire second school virtually.

- In 2020, 19 College Freshman Scholarships awarded to students who work for or have a parent who works for a LBA member bank, bringing the total amount awarded as scholarships since 2001 to $364,229

- $1,013,547 total balance, including contributions and pledges, to the Louisiana Bankers Patrick Spencer/FISC Education Foundation

(Some of the above pictures were taken prior to the pandemic.)

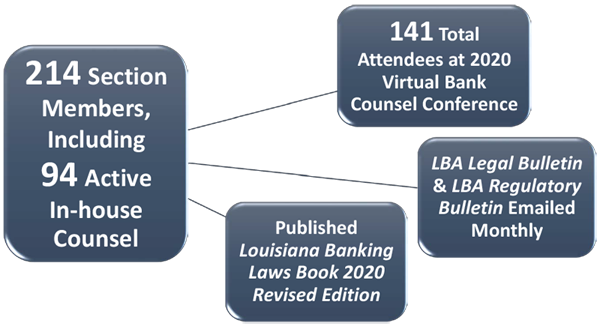

Bank Counsel Section

The LBA Bank Counsel Section consists of bank attorneys that work as both in-house and outside counsel. The section members, under the direction of the Bank Counsel Committee members, assist in drafting legislation and work closely with the LBA government relations and legal staff throughout the year.

Endorsed Products & Associate Members

LBA Endorsed Products and

Associate Members provide banks with superior products and services. These partners are industry leaders who share LBA's high standard for quality service.

15 Total LBA Endorsed Vendors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LBA Associate Members "associate" themselves with Louisiana's commercial banks and thrifts by monitoring developments in the banking industry with the information they receive from the Association.

The Community Cash alliance served as a disaster recovery aid for displaced customers of alliance members as Louisiana experienced a record number of hurricanes making landfall in 2020. In 2020, the alliance had 18 participants with more than 652 ATM locations in 8 states. Community Cash is a surcharge-free ATM alliance allowing participating banks’ customers access to the combined ATM locations.

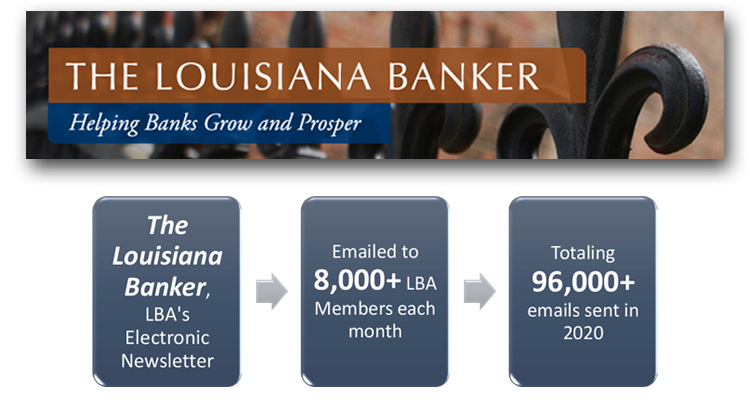

Communications

LBA Communications keeps bankers informed, delivering critical industry information to members about legislative and regulatory changes as well as conferences, programs and products and services that are available to members.

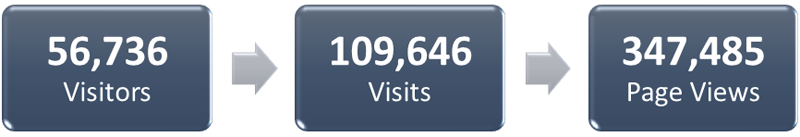

LBA.org

On average each month in 2020, more than 4,700 visitors together made about 9,100 visits to LBA's website, viewing almost 29,000 pages as they browsed. There are more than 10,000 registered website users and the most popular pages continue to be the Education Calendar, Classifieds, Peer Group Pages, Press Releases & Photo Gallery, The Louisiana Banker newsletter and The Bankers Directory, with one new section to add to the most popular list for 2020—Coronavirus Resources.

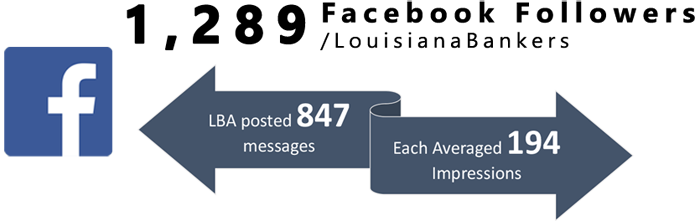

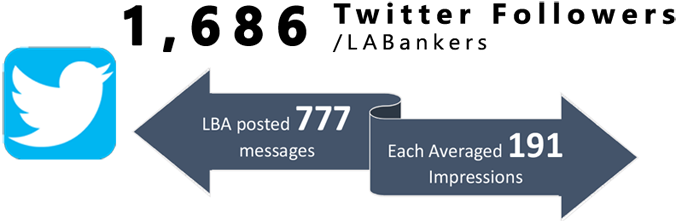

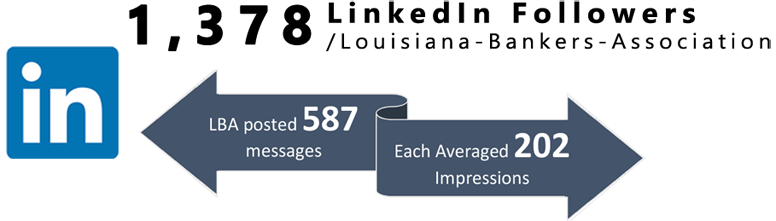

Social Media

The LBA regularly posts resources covering topics like financial literacy, identity theft and emergency preparedness on Facebook, Twitter and LinkedIn that can be re-posted or re-tweeted on members’ social media outlets to benefit their customers.

In 2020, LBA introduced three hashtags to help spread good news about Louisiana banking.

- #FinLitLouisiana showcases the many financial literacy programs and community projects going on around the state.

- #LouisianaBanksSupportingLouisiana showcases the ways Louisiana bankers are tirelessly working to help neighbors and local businesses.

- #HolidayCheerPhotoChallenge was issued to help spread holiday cheer.

2020 Social Media Statistics

- Top post not only for 2020, but also since LBA began tracking, with 19,754 impressions and 505 reactions: LBA releases a statement asking for patience with the Paycheck Protection Program. Everyone is eager for the program's implementation, but to date, the PPP guidelines have not been finalized. Click here to read more: http://ow.ly/QVZd50z3QKl

- Most popular tweet in 2020 with 1,543 impressions and 12 reactions: Congratulations to First Guaranty Bank's Randy Vicknair for being named to Independent Banker Magazine's 40 Under 40: Emerging Community Bank Leaders! Click here to see the feature: http://ow.ly/G1V350AaDdJ

- Top LinkedIn post in 2020, with 2,514 impressions and 231 reactions: We know Louisiana bankers are tirelessly working to help their neighbors & local businesses deal with the fallout of the COIVD-19 pandemic. We are grateful for their efforts & are proud to stand with them. http://ow.ly/jAZH50zr2gm